Beyond the Triple Bottom Line: 5 Revolutions in Valuing Public Infrastructure

Introduction: The Measurement Gap

You know the problem. You're sitting in a budget meeting with a transformative project—one that will genuinely improve public health, reduce flood risk, and cut emissions. The numbers are solid. The engineering is sound. But when the CFO asks, "What's the ROI?" you're stuck translating community resilience into language that competes with a new treatment plant that has a clear payback period.

For decades, we've been forced to justify infrastructure by cost and compliance alone—not by the total value it creates for people, the planet, or the public good. This measurement gap doesn't just make funding harder. It systematically undervalues the projects that matter most.

The Triple Bottom Line gave us permission to think bigger. It said: measure People, Planet, and Profit. That was revolutionary twenty years ago. But today? It's not enough. In an era of climate uncertainty, tight budgets, and demands for radical transparency, you need more than a framework that asks you to "balance" competing priorities. You need a system that proves integrated value with verifiable data.

What follows are five fundamental shifts in how we measure, govern, and prioritize infrastructure investments. These aren't incremental improvements. They're revolutions in thinking that transform every project into auditable proof of impact.

Revolution 1: Governance Isn't a Footnote—It's the Foundation of Trust

The Old Way: Governance was the compliance section at the back of your report. A few paragraphs about following procurement rules. Maybe a nod to public engagement.

The New Reality: Governance is the invisible infrastructure of trust. It's not what you build—it's how you build. And in 2025, that's what separates fundable projects from wishful thinking.

This isn't box-checking. It's a rigorous methodology for measuring transparency, ethics, public participation, and data integrity. The framework operationalizes governance through auditable metrics drawn from GRC (Governance, Risk, and Compliance):

Transparency & Accountability

- Track the % of datasets that are public

- Document audit cadence and external review cycles

- Maintain public-facing dashboards, not just internal reports

Data Governance & Security

- Verify metadata completeness across all project datasets

- Ensure data lineage is intact and traceable

- Implement Row-Level Security (RLS) to properly scope access

Ethics & Compliance

- Demonstrate ISO/NIST adherence, not just awareness

- Pass algorithmic bias tests to ensure equity in modeling

- Document stakeholder engagement with measurable participation metrics

Here's why this matters: This integrity layer becomes the non-negotiable prerequisite for everything else. Every social benefit claim, every environmental value calculation, every risk assessment—all of it stands on this foundation. Without it, you're building a house on sand.

Framework Takeaway: Transform your project proposals from a set of claims into a portfolio of auditable assets. This fundamentally de-risks investment decisions because systems are only as resilient as the integrity of those who run them.

Revolution 2: You Can—and Must—Put a Price on People and Planet

The Old Narrative: "Sure, this green infrastructure project improves air quality and reduces urban heat, but we can't really quantify that. Those are soft benefits."

The Truth: That's a choice, not a limitation.

Triple Bottom Line Cost-Benefit Analysis (TBL-CBA) systematically monetizes social and environmental benefits alongside financial costs. The result is a project's total Sustainable Net Present Value (SNPV)—a number that includes everything, not just what's easy to count.

This isn't guesswork. It's a data-driven methodology that leverages authoritative sources: EPA, FEMA, NOAA, BEA, WRF, Census, EIA, and USGS. By applying established valuation factors from these agencies, you convert abstract benefits into concrete, defensible dollar values:

Public Health

- Avoided illness valued using EPA health valuations and the social value of statistical life (SVSL)

- Reduced emergency room visits from heat-related illness

- Decreased respiratory disease from improved air quality

Air Quality

- EPA damage cost per ton for pollutants (PM2.5, NOx, SOx)

- Quantified impact on worker productivity and school attendance

- Monetized ecosystem services from vegetation and green infrastructure

Climate/Carbon

- Social Cost of Carbon (SCC) for emissions reduction

- Avoided climate adaptation costs

- Carbon sequestration value for natural infrastructure

Safety

- FEMA damage and disruption valuations for flood risk reduction

- Avoided injuries and displacement costs

- Property protection and business continuity value

Real-World Proof: In Pima County, Arizona, TBL-CBA evaluated two green infrastructure projects. The analysis found that environmental and social benefits were more than six times greater than project costs over the lifecycle. Under climate change scenarios, the model showed the park's cooling and air quality benefits would roughly double—proving long-term resilience value.

That data wasn't just interesting. It was the key data for approving the green infrastructure plan. Because when you can show that a $2M investment delivers $12M in total public value, the conversation changes completely.

Framework Takeaway: Stop accepting "we can't measure that" as an answer. The methodologies exist. The data sources are public. The only question is whether you're willing to use them to tell the complete story of your project's value.

Revolution 3: Resilience Is a Behavior, Not a Snapshot

The Old Approach: Build a stronger bridge. Raise the seawall. Check the "resilient" box.

The New Paradigm: Resilience is not an event. It's a behavior.

Static hardening isn't enough when the future is uncertain and accelerating. Real resilience means designing systems that learn from stress, recover efficiently, and adapt over time. This behavioral approach is measured through forward-looking metrics that quantify risk reduction and adaptive governance:

Climate Adaptation

- Evaluate projects across multiple climate scenarios (RCP/SSP pathways)

- Visualize NPV robustness in fan charts showing performance under uncertainty

- Design for flexibility, not a single predicted future

Recovery & Learning

- Track Mean Time To Repair (MTTR) improvements after events

- Document post-event SOP updates as evidence of institutional learning

- Create quantifiable operational risk reduction through iteration

Continuous Improvement

- Measure Δ CIP/year—the annual change in composite impact score

- Track certification level-ups (Bronze → Silver → Gold → Platinum)

- Prove the system is becoming more robust over time, not just maintaining baseline

This moves you beyond hardening assets to building adaptive capacity directly into infrastructure planning. It ensures projects remain valuable and functional as conditions inevitably change.

Framework Takeaway: True resilience is measured in cycles, not snapshots. If your resilience metrics don't track learning and adaptation, you're measuring the wrong thing.

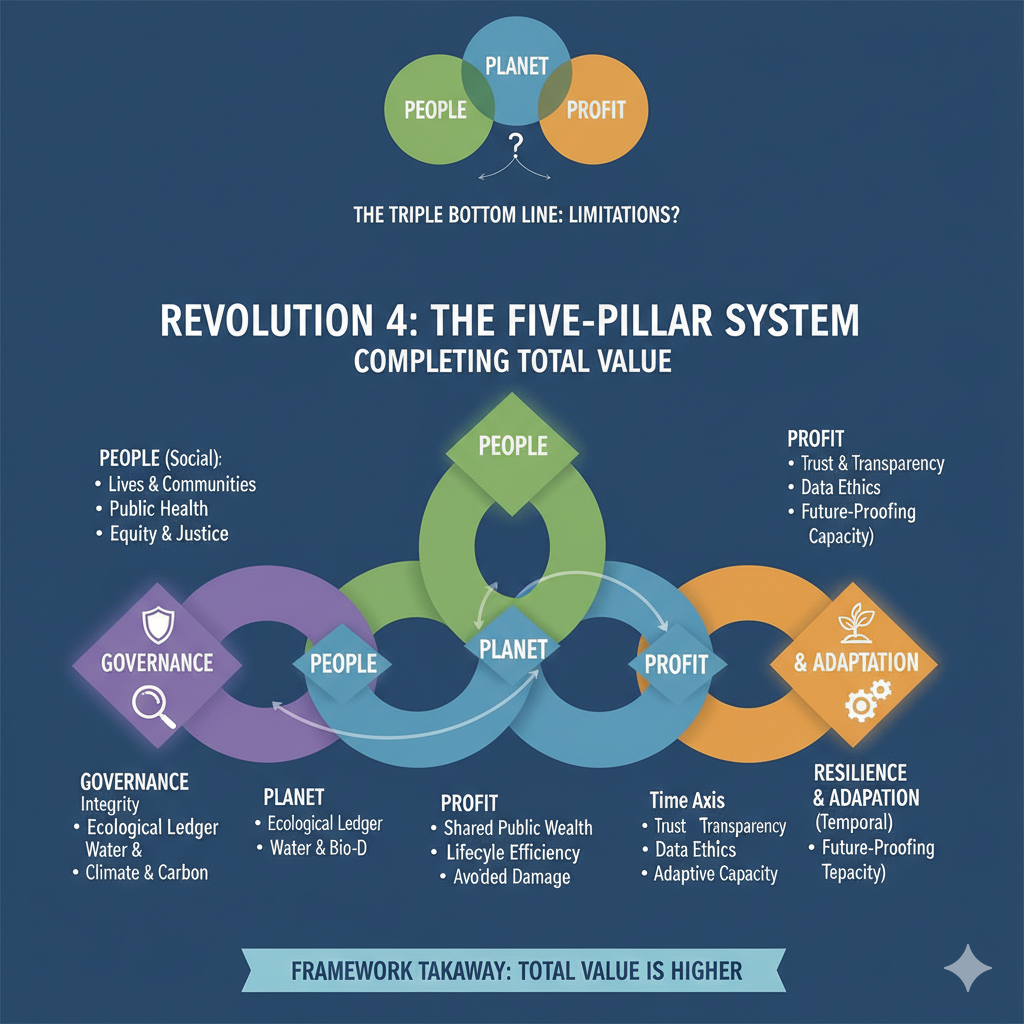

Revolution 4: The Triple Bottom Line Is Evolving into a Five-Pillar System

The Limitation of TBL: The Triple Bottom Line asked you to balance People, Planet, and Profit. But how do you balance? What happens when they conflict? And where does governance fit? What about the time horizon?

The Evolution: To meet modern demands for accountability and long-term viability, the framework expands into a five-dimensional system by explicitly adding Governance and Resilience & Adaptation as measurable pillars.

Each pillar plays a distinct role:

PEOPLE (Social)

- Quantifies improvements to lives and communities

- Measures Public Health outcomes, Equity & Environmental Justice impacts

- Restores social balance by making community benefits visible and verifiable

PLANET (Environmental)

- Internalizes environmental externalities through a transparent "ecological ledger"

- Tracks Water Quality, Biodiversity, Land Use, and Climate/Carbon impacts

- Converts environmental value from abstract to auditable

PROFIT (Economic)

- Reframes fiscal value as shared, long-term public wealth

- Monetizes Lifecycle Cost Efficiency and Avoided Damage/Loss

- Proves economic returns extend far beyond initial capital costs

GOVERNANCE (Cross-Cutting Integrity)

- Adds the essential "integrity layer" across all domains

- Ensures the entire system is built on trust and transparency

- Makes data governance, ethics, and accountability measurable

RESILIENCE & ADAPTATION (Temporal Axis)

- Adds the "time axis" to infrastructure valuation

- Future-proofs investment by measuring learning and evolution capability

- Quantifies adaptive capacity, not just current performance

This evolution from three to five pillars provides a complete and defensible picture of total value. By explicitly accounting for trust (Governance) and time (Resilience), you create a framework that justifies investments not just for today, but for an uncertain future.

Framework Takeaway: The five-pillar system doesn't replace TBL—it completes it. Use it to prove that the projects serving multiple bottom lines aren't harder to justify. They're easier, because the total value is higher.

Revolution 5: From Spreadsheets to an Auditable Operating System

The Old Reality: Fragmented metrics. Static spreadsheets. Qualitative scorecards that were impossible to audit, compare, or scale. Every analysis reinventing the wheel. Every project a one-off justification.

The Final Revolution: An integrated, systematic framework—a complete operating system for infrastructure valuation.

This system turns principles into practice through a seamless, auditable workflow:

Data Ingestion

- Import project metrics via CSV/Excel/GIS

- Map to standardized NIDD-canonical fields

- Create a single source of truth across all projects

Automated Valuation

- Transparent engines apply factors from a version-controlled catalog

- Use public data sources (EPA, FEMA, NOAA, etc.)

- Generate consistent valuations across your entire portfolio

Actionable Outputs

- Providence Card: Domain-by-domain verified impact ledger for each project

- Proof of Impact: Sustainable NPV, Benefit-Cost Ratio, and monetized externalities

- CIP Score: Composite prioritization score for capital planning

- GRC-Backed Certification: Bronze to Platinum tiers proving governance maturity

Auditability

- Permanent audit trail with versioning tables

- Logged factor sources and methodological decisions

- Content_hash snapshots of data at key decision points

This systematic approach makes the previous four revolutions operational at scale. It transforms abstract values into a living, open ledger—a digital twin of integrity that provides verifiable, data-backed proof for governance, prioritization, and risk management.

Framework Takeaway: You can't scale trust without systems. This operating system is what makes holistic valuation practical for every project in your CIP, not just the showcase initiatives.

Conclusion: From Compliance to Confidence

The future of public infrastructure isn't just about what we build. It's about our ability to prove holistic value with integrity.

These five revolutions mark a fundamental shift—from building isolated projects judged by cost and compliance to creating an interconnected ecosystem of accountability. From compliance to confidence.

If the Triple Bottom Line was the first step toward sustainability, this new operating system is the leap toward legitimacy.

The question for every utility and public agency is no longer if we should measure total impact. It's how we will prove it.

What language of proof will you speak?

Providence is the language of that proof.